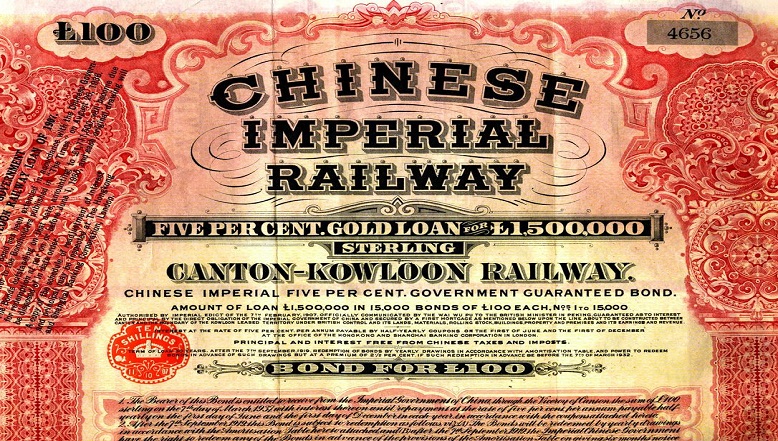

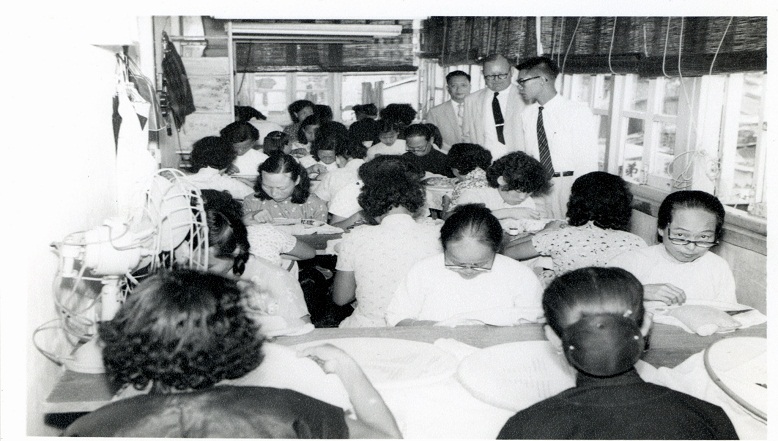

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in Bermuda

Our services

HSBC Bermuda is a leading provider of financial services in Bermuda, serving individuals, institutions, and corporations locally and globally.

Through our International Wealth and Premier Banking and Corporate and Institutional Banking businesses, we are a leading provider of retail, investment, custody, insurance and fund administration products and services to international and local clients.

Our headquarters

37 Front Street

Hamilton

HM11, Bermuda

Our CEO

Gregory Garnier

Our history in Bermuda

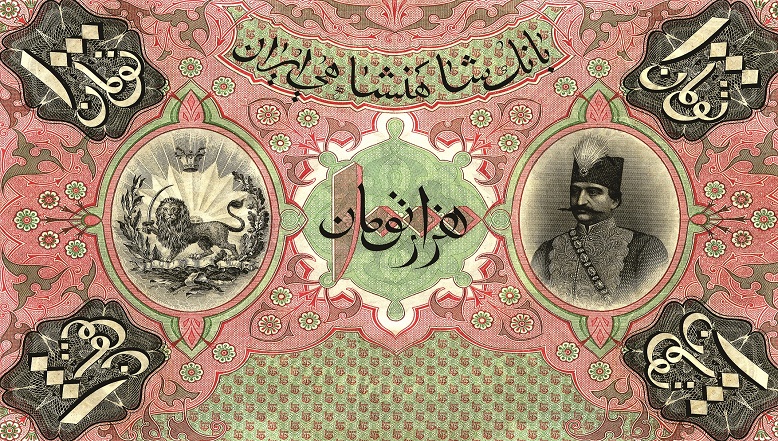

Bank of Bermuda Limited was founded in 1889 and acquired by HSBC (and renamed HSBC Bank Bermuda Limited) in 2004.

HSBC Bank Bermuda Limited (the Bank) remains incorporated in Bermuda, and is licensed and regulated to conduct Banking and Investment Business by the Bermuda Monetary Authority. It is wholly owned by HSBC Bank plc. When Bank of Bermuda de-listed from the Bermuda Stock Exchange (BSX) in 2004, HSBC Holdings took a secondary listing on the BSX, which remains in place.

The Bank, headquartered at 37 Front Street Hamilton, operates out of three branches. The bank provides a full range of banking and asset management services to retail and corporate clients and differentiates itself in the Bermuda market through its ability to connect clients internationally through HSBC’s global network. The Bank is rated A- by S&P and, at end 2023, held approximately 55 per cent of Bermuda’s total deposits.

Financial information

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 20 August 2025 English PDF 213.90 KB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2025 English PDF 362.42 KB

- Download Consolidated Financial Statements English PDF 3.45 MB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2024 English PDF 371.39 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 9 October 2024 English PDF 1.25 MB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2024 English PDF 247.93 KB

- Download Consolidated Financial Statements English PDF 3.51 MB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2023 English PDF 238.40 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 11 September 2023 English PDF 1.02 MB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2023 English PDF 212.71 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 28 July 2022 English PDF 878.01 KB

- Download Consolidated Financial Statements English PDF 3.15 MB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2022 English PDF 229.64 KB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2022 English PDF 330.17 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 28 July 2021 English PDF 786.39 KB

- Download Consolidated Financial Statements English PDF 3.16 MB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2021 English PDF 233.94 KB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2021 English PDF 195.26 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 30 November 2020 English PDF 777.59 KB

- Download Consolidated Financial Statements English PDF 3.17 MB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2020 English PDF 224.39 KB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2020 English PDF 364.47 KB

- Download Capital and Risk Management Final Pillar 3 Disclosures at 31 December 2019 English PDF 397.39 KB

- Download Consolidated Financial Statements English PDF 3.27 MB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 25 November 2019 English PDF 778.99 KB

- Download Capital and Risk Management Interim Pillar 3 Disclosures at 30 June 2019 English PDF 363.96 KB

- Download Standard & Poor’s review of HSBC Bank Bermuda Ltd - 19 February 2019 English PDF 279.09 KB

The Site is primarily intended for those who access it from within Bermuda. Because of this, we cannot guarantee that the Site or the information thereon complies with law or regulation of other countries, or is appropriate for use, in other places. You are wholly responsible for use of the Site by any person using your computer and you must ensure that any such person complies with these Terms. The information provided on this Site is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or regulation. This Site should not be considered as communicating any invitation or inducement to engage in banking of investment activity or any offer to buy or sell any securities or other instruments outside Bermuda.